Routine care add-ons for pet insurance play a pivotal role in ensuring your furry friends remain healthy and happy. These add-ons cover essential services that go beyond mere emergency care, offering a holistic approach to pet wellness that every responsible pet owner should consider.

By understanding the importance of these add-ons and the services they include, you can make informed decisions that contribute positively to your pet’s overall health and well-being.

Understanding Routine Care Add-Ons for Pet Insurance

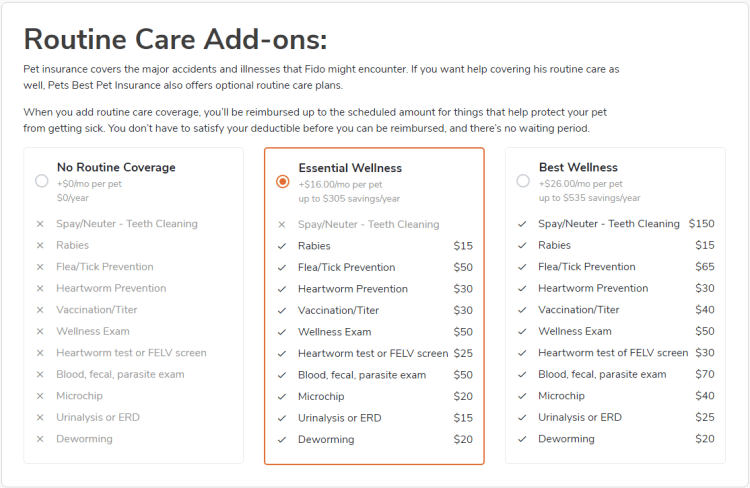

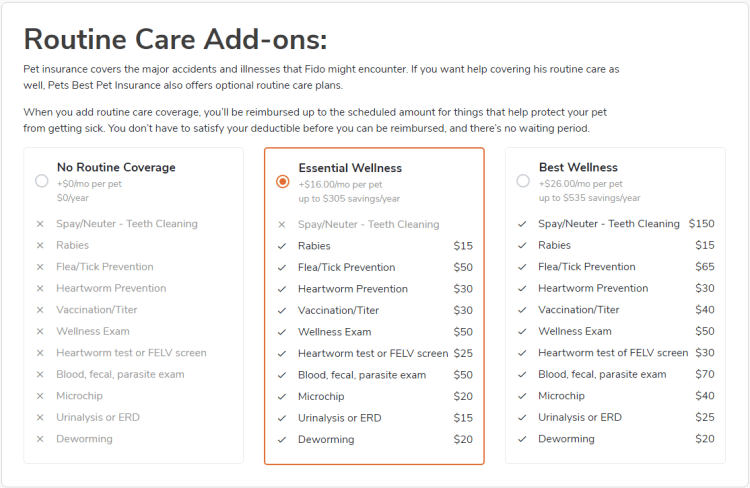

Routine care add-ons for pet insurance play a crucial role in ensuring the long-term health of your furry companions. These add-ons extend coverage beyond unexpected accidents and illnesses, emphasizing preventive care that can lead to a healthier, happier life for pets. With the rising costs of veterinary care, routine care add-ons provide a financial safety net, making it easier for pet owners to prioritize their pet’s health without the stress of unexpected expenses.Routine care services typically covered by these add-ons include regular veterinary check-ups, vaccinations, dental cleanings, and preventative medications.

By incorporating these services into your pet insurance policy, you can ensure your pet receives the necessary care to prevent serious health issues. The importance of these services lies in their ability to catch potential problems early, allowing for timely intervention and treatment.

Common Types of Routine Care Services Covered

Routine care add-ons cover a variety of essential services aimed at maintaining your pet’s overall health. Understanding these services can help you make informed decisions about your pet’s healthcare needs. Here are some common types of routine care services included in these add-ons:

- Annual Wellness Exams: Regular check-ups are vital for assessing your pet’s health, monitoring weight, and detecting early signs of illness.

- Vaccinations: Keeping up with vaccinations is essential to protect your pet against various diseases, including rabies and distemper.

- Dental Cleanings: Routine dental care prevents plaque buildup, gum disease, and other serious dental issues that can affect overall health.

- Preventative Medications: This includes flea, tick, and heartworm prevention, crucial in protecting your pet from parasites and related diseases.

- Spaying and Neutering: These surgical procedures not only prevent unwanted litters but can also reduce the risk of certain health issues.

Routine care add-ons are integral to enhancing your pet’s health and well-being. By regularly engaging in preventive services, pet owners can help ensure that their pets live longer and healthier lives. This proactive approach not only minimizes the risk of severe health problems but also contributes to better behavior and quality of life. Investing in routine care now can lead to substantial savings in treatment costs down the line, highlighting the value these add-ons bring to pet insurance policies.

Comparing Different Types of Insurance for Pets

Pet insurance offers a safety net for unexpected veterinary expenses, while supplemental insurance provides additional coverage for routine care, wellness visits, and more. Understanding the distinctions between these types of insurance can help pet owners make informed decisions regarding their furry companions’ health and well-being.Pet insurance generally covers accidents, illnesses, and emergencies, providing financial support when a pet requires medical attention.

This type of insurance can alleviate significant financial burdens during critical moments. In contrast, supplemental insurance typically focuses on preventive care and wellness, covering expenses that pet owners might encounter regularly, such as vaccinations, dental cleanings, and routine check-ups. The key difference lies in their intended purpose: pet insurance is essential for unforeseen health incidents, while supplemental insurance fills in the gaps for standard care needs.

Travel Insurance for Pets

Travel insurance specifically designed for pets is an invaluable resource for pet owners who frequently travel with their animals. This type of insurance provides coverage for various scenarios that may arise while traveling, ensuring the safety and well-being of pets during trips.Some important aspects of travel insurance for pets include:

- Trip Cancellation Coverage: If a pet becomes ill or injured before a planned trip, travel insurance can reimburse non-refundable expenses.

- Emergency Medical Coverage: In the event of a pet getting injured or falling ill while away from home, this insurance can cover veterinary costs incurred during travel.

- Lost Pet Assistance: Many travel insurance policies include provisions for searching for lost or missing pets while traveling, providing peace of mind to pet owners.

- Quarantine Coverage: If a pet must be quarantined due to travel regulations or health concerns, this insurance may help cover the associated costs.

Travel insurance for pets is designed to protect both the pet and the owner from unexpected circumstances, enhancing the travel experience and reducing stress.

Umbrella Insurance for Pet Ownership Liabilities

Umbrella insurance plays a crucial role in safeguarding pet owners against additional liabilities that may arise from pet ownership. This type of insurance provides an extra layer of protection, extending the coverage limits of existing policies, such as homeowners or renters insurance.Key features of umbrella insurance for pet ownership include:

- Liability Protection: If a pet causes injury to another person or damages their property, umbrella insurance can cover legal fees and damages beyond the limits of standard policies.

- Coverage for Multiple Pets: For households with multiple pets, umbrella insurance can provide comprehensive coverage, protecting against various potential incidents involving different animals.

- Peace of Mind: This insurance allows pet owners to feel secure knowing they have financial protection in case of unexpected incidents that may lead to legal action.

- Excess Liability Coverage: Umbrella policies usually offer higher liability limits, providing additional security for pet owners against significant claims.

Understanding the role of umbrella insurance can help pet owners navigate potential liabilities associated with their pets, ensuring that they are adequately protected in unforeseen situations.

Comprehensive Coverage

Comprehensive pet insurance goes beyond the basics, offering various add-ons that enhance the care and protection of our furry friends. Among these options are vision insurance and watercraft insurance, both of which cater to specific needs that pet owners may have. Understanding these additional coverages can help ensure that pets receive the best possible care in a variety of situations.

Vision Insurance for Pets

Vision insurance for pets focuses on maintaining and protecting their eye health, which is crucial for their quality of life. Just like humans, pets can experience a range of vision-related issues, including cataracts, glaucoma, and retinal diseases. Regular eye check-ups and preventive care can help catch potential problems early, ultimately leading to better outcomes.

Routine eye exams can detect conditions before they become serious, allowing for timely intervention.

Investing in vision insurance can provide pet owners with peace of mind while significantly reducing out-of-pocket expenses for treatments and surgeries. The coverage typically includes:

- Annual eye examinations

- Diagnostic tests for eye conditions

- Coverage for surgical procedures related to eye health

- Medications and treatments prescribed for eye disorders

Watercraft Insurance for Pet Owners

For pet owners who enjoy aquatic activities, watercraft insurance can be an essential addition to their insurance portfolio. This coverage protects both the pet and the owner, ensuring that enjoyable outings on the water remain safe and secure. Watercraft insurance typically covers incidents such as accidents, injuries, and damage that may occur while boating with pets. It also extends to liability for any damage or injuries caused by the pet during these activities.

Having the right coverage can make all the difference in ensuring a fun, worry-free experience on the water with your pet.

Features of watercraft insurance may include:

- Liability coverage for pet-related incidents

- Coverage for pet injuries sustained while on the water

- Protection against damage to the watercraft caused by the pet

- Emergency services, including veterinary care if needed while away from home

Comparison of Supplemental Insurance Types

Understanding the various supplemental insurance options available to pet owners is key to making informed decisions. Below is a comparison table showcasing the features of vision insurance and watercraft insurance for pets.

| Type of Insurance | Key Features | Benefits |

|---|---|---|

| Vision Insurance | Annual exams, diagnostic tests, surgeries, medications | Early detection of eye issues, reduced treatment costs |

| Watercraft Insurance | Liability coverage, injury protection, damage coverage | Peace of mind during water activities, safety for pets |

Final Summary

In summary, routine care add-ons for pet insurance are not just an extra expense; they are an investment in your pet’s long-term health. By utilizing these add-ons, you ensure that your beloved companion receives the preventive care necessary to live a vibrant life.

FAQ Summary

What are routine care add-ons in pet insurance?

Routine care add-ons cover preventive services like vaccinations, dental cleanings, and wellness exams.

Are routine care add-ons worth the extra cost?

Yes, they often save money on essential preventive care and enhance your pet’s overall health.

Do all pet insurance policies offer routine care add-ons?

No, not all policies include these add-ons, so it’s essential to check the details of your specific plan.

Can I customize routine care add-ons in my pet insurance?

Some providers allow customization of add-ons to suit your pet’s unique needs.

How do I file a claim for routine care services?

Claims can usually be filed online or through an app by submitting receipts for covered services.