The Pet insurance comparison chart serves as your guide to navigating the often-confusing world of pet insurance. Understanding the importance of insuring your furry companions can lead to saving significant costs during unexpected veterinary visits. With various types of insurance plans available, each offering different coverage options, it’s essential for pet owners to have access to comprehensive and clear comparisons.

This chart not only showcases the top pet insurance providers but also Artikels their premium rates and coverage options, allowing for informed decisions that can ensure your pet receives the care they need without breaking the bank.

Pet Insurance Basics

Pet insurance serves as a safety net for pet owners, ensuring that financial constraints do not prevent them from providing necessary medical care for their furry companions. Pet insurance can significantly alleviate the stress and anxiety associated with unexpected veterinary bills, allowing pet owners to focus on their pet’s health rather than their finances.Understanding the diverse types of pet insurance plans available is critical for pet owners to make informed decisions.

Generally, pet insurance can be categorized into three main types: accident-only plans, comprehensive plans, and wellness plans. Each plan offers different coverage options tailored to various needs and budgets, making it essential to evaluate which plan best fits a pet owner’s circumstances.

Types of Pet Insurance Plans

The selection of a pet insurance plan should align with the specific needs of a pet and the owner’s financial situation. Below are the primary types of pet insurance plans available:

- Accident-Only Plans: These plans cover veterinary costs associated with accidental injuries, such as fractures or poisonings, but do not cover illnesses.

- Comprehensive Plans: Also known as accident and illness plans, these provide broader coverage for both injuries and various illnesses, including chronic conditions.

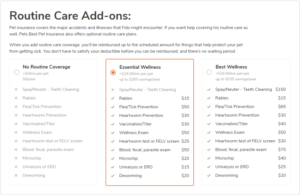

- Wellness Plans: These plans focus on preventative care, covering routine check-ups, vaccinations, and dental cleanings, often available as add-ons to other plans.

Investing in a comprehensive plan can often be more beneficial in the long run, as pets can develop health issues that may lead to costly treatments.

Comparison of Top Pet Insurance Providers

When selecting a pet insurance provider, it is important to consider coverage options, premiums, and customer service. Below is a comparison chart highlighting some of the top pet insurance companies:

| Provider | Coverage Options | Average Premiums (Monthly) |

|---|---|---|

| Healthy Paws | Accident & Illness, No Caps on Payouts | $40-$60 |

| Petplan | Accident & Illness, Dental Coverage | $30-$50 |

| Trupanion | Accident & Illness, Direct Vet Pay | $35-$70 |

| Embrace | Accident & Illness, Wellness Add-Ons | $25-$55 |

Evaluating the coverage options and monthly premiums is vital in selecting the right plan. Pet owners should also consider factors such as deductibles, reimbursement percentages, and any breed-specific exclusions.

“Having pet insurance can save you thousands of dollars over the life of your pet, allowing you to make medical decisions based on what is best for your pet rather than what you can afford.”

Supplemental Insurance for Pets

Supplemental insurance for pets is designed to enhance the coverage provided by standard pet insurance policies. It fills gaps in coverage for specific health services and conditions not typically included in standard plans, ensuring comprehensive care for your furry friends. This additional layer of protection can cover a variety of services, from routine wellness exams to alternative therapies, offering pet owners peace of mind.Supplemental insurance can be particularly advantageous for pet owners who want to ensure their pets receive the best possible care without facing significant out-of-pocket expenses.

By understanding the different options available, pet owners can select a plan that aligns with their pets’ health needs and their budgeting preferences.

Comparison of Supplemental Insurance Options

When considering supplemental insurance, it’s essential to compare the benefits and coverage details alongside standard pet insurance. The following table illustrates the primary differences in coverage between supplemental plans and standard pet insurance.

| Coverage Aspect | Standard Pet Insurance | Supplemental Insurance |

|---|---|---|

| Accident Coverage | Yes, typically covers most accidents | May not cover accidents, depends on the plan |

| Illness Coverage | Yes, covers various illnesses | Can cover additional treatments not included in standard plans |

| Preventive Care | Often limited or not included | Usually covers routine check-ups and vaccinations |

| Alternative Therapies | Rarely covered | Commonly included (acupuncture, chiropractic care) |

| Coverage Limits | Annual limits may apply | Often higher or no limits for specific treatments |

The need for supplemental insurance can be attributed to the increasing cost of veterinary care. For instance, a standard pet insurance policy may only cover a portion of a surgery, while a supplemental plan could cover complementary therapies that enhance recovery, like physical rehabilitation, which can be critical for pets recovering from surgery. By evaluating individual pet needs and healthcare options, owners can make informed decisions that provide optimal coverage.

Related Insurance Types

When it comes to pet ownership, various insurance types can provide additional coverage and peace of mind beyond standard pet insurance. Understanding these related insurance types is essential for pet owners who want to ensure their furry companions are protected in a variety of situations, including travel, liability, and even specific health conditions. Below are some pertinent types of insurance that pet owners should consider.

Travel Insurance for Pets

Travel insurance for pets is designed to protect both pet owners and their animals during trips. This insurance covers unexpected events such as trip cancellations, emergency medical expenses for pets while traveling, and even lost pet recovery. Purchasing this type of insurance is crucial for pet owners who frequently travel, as it can save them from significant financial losses and ensure the safety of their pets.

Key benefits include:

- Coverage for veterinary emergencies while away from home.

- Reimbursement for cancellation fees due to pet illness.

- Assistance in finding a veterinarian or emergency clinic during travel.

“Travel insurance for pets provides peace of mind, allowing pet owners to focus on enjoying their journey.”

Umbrella Insurance and Pet Ownership

Umbrella insurance offers an additional layer of liability coverage for pet owners, particularly useful in cases involving dog bites or other pet-related incidents. This type of insurance kicks in once the limits of the homeowner’s or renter’s insurance have been reached. It is particularly relevant for owners of breeds that may be considered high-risk. The importance of umbrella insurance includes:

- Protection against lawsuits resulting from personal injury or property damage caused by pets.

- Increased coverage limits that go beyond standard homeowners or renters insurance.

- Coverage for incidents that occur outside the home, providing broader protection.

“Having umbrella insurance can be a wise choice for pet owners, offering robust liability protection.”

Vision Insurance for Pets

Vision insurance for pets is a specialized coverage that assists in covering the costs associated with common eye conditions affecting animals. This insurance is increasingly relevant as more pet owners recognize the importance of their pets’ ocular health. Coverage typically includes:

- Regular eye examinations.

- Treatment for conditions such as cataracts, glaucoma, and retinal disorders.

- Costs associated with surgeries and medications for eye health.

“Vision insurance for pets can help cover expensive treatments, ensuring pets receive necessary care for their sight.”

Watercraft Insurance and Pets

Watercraft insurance is particularly relevant for pet owners who enjoy boating or other aquatic activities with their pets. This type of insurance can provide coverage for various incidents that may occur on the water, including accidents involving pets. Important aspects to consider include:

- Liability protection in case a pet causes injury to another person while on a watercraft.

- Coverage for pets that may get injured during water-related activities.

- Reimbursement for medical expenses if a pet requires treatment after an accident on the water.

“Watercraft insurance ensures that pet owners can enjoy aquatic adventures without worrying about potential mishaps.”

Final Review

In summary, the Pet insurance comparison chart highlights the various options available to pet owners, empowering you to choose the right insurance for your beloved pets. With a clearer understanding of the different plans and supplemental options, you can better protect your furry friends, ensuring their health and wellbeing while also managing your finances effectively. Remember, investing in pet insurance today can lead to peace of mind tomorrow.

FAQs

What is pet insurance?

Pet insurance is a policy that helps cover the costs of veterinary care for your pets, including accidents and illnesses.

How do I choose the right pet insurance plan?

Consider factors such as coverage options, premiums, deductibles, and your pet’s specific needs when choosing a plan.

Are pre-existing conditions covered by pet insurance?

No, most pet insurance plans do not cover pre-existing conditions, so it’s essential to enroll while your pet is healthy.

Can I use any vet with pet insurance?

Most pet insurance plans allow you to visit any licensed veterinarian, but check if your chosen plan has any network restrictions.

What is supplemental pet insurance?

Supplemental pet insurance provides additional coverage beyond standard policies, often covering alternative treatments and specialized care.